Before we discuss the painful sentiments of the fintech market’s competition, saturation, and the number of fintech apps getting uninstalled daily -well, that’s a bit scary.

We all know that financial tech solutions, from a consumer’s point of view, are often boring or irrelevant until or unless they really hit the nail. Customers only care about how it will add value and ease their lifestyle.

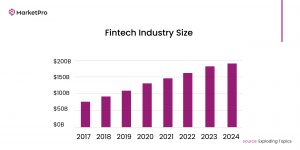

The global fintech industry’s revenue increased 100% from 2017 to 2024, from approximately $84 billion to $197 billion.

Well, it seems like it’s all good, then.

Nope, not at all. The unprecedented rise in uninstall rates for fintech apps is spinning the minds of startups and firms, too. With only 16% of the average annual retention rate for fintech apps, this shows customers can simply hop on another ride when promised more rewards and better services from competitors.

Businesses need a refined fintech marketing strategy and tactics to understand today’s marketplace better. This article will cover all the necessary points to help you stay relevant to current market trends.

What is Fintech Marketing?

Fintech involves a specialized compilation of marketing strategies, combining advanced technology and traditional finance. Financial tech firms execute this unique blend to improve and automate the supply and usage of their financial tech services.

Usual marketing strategies don’t work here, considering that their complex and somewhat complicated topics sometimes wear out their clients and consumers. Businesses work on simplifying their solutions and terms to catch their interests and stand out among their competitors.

How Fintech Marketing Strategies Move the Needle?

As of 2022, digital banking is utilized by around 65.3% of the population in the United States.

With fintech’s rampant growth and a massive rise in global revenue, businesses are investing heavily in this market. However, many firms are stuck in the old marketing traditional era and are losing against their competitors.

The key to winning their consumer’s hearts is to blend traditional finance practices with advanced technological terms and implement fintech digital marketing strategies and techniques specifically catered to the present.

Some of their unique benefits are:

Enhanced Literacy: Firms and startups usually ‘spray and pray’ when it comes to educating their advanced use cases and financial concepts. However, with fintech marketing, businesses can incorporate educational components in their models, guiding their customers about their products and services and ultimately enhancing their financial decisions.

Personalized Tips: AI and Machine Learning (ML) can help businesses provide personal recommendations to their customers, examining users’ personal financial practices and goals and providing tailored financial insights to their table.

Tackling Fraud: With social media and content marketing practices, firms can showcase their cyber-security and fraud-tackling measures to instill consumer confidence and assurance regarding their personal and financial information.

Tapping Marginalized Audience: Companies can grab populations’ attention with limited fintech options in fintech marketing. With their campaigns, businesses can offer alternative tech solutions, showcasing their efforts to bridge the financial gap and empower deprecated communities.

Building Trust: Fintech marketing leverages the presence of different marketing channels, showcasing its authority and responsibility for its customers. Fintech companies can openly create and show transparency on customers’ charges or demands rather than hiding information.

Future-Proof Strategies of Fintech Marketing

After discovering the benefits of fintech marketing, let’s discuss some crucial strategies and techniques for better understanding the target audience.

Experience Marketing

Many businesses are using experienced marketing tactics and techniques for their fintech models. In fact, it’s an effective way of creating and establishing physical interaction with the target audience.

With interactive demos, businesses can create hands-on, exciting experiences to help customers understand their products or services. Numerous fintech firms are leveraging the transformative potential of Augmented Reality (AR) and Virtual Reality (VR) to innovate real-world financial situations.

Example: TransferWise’s “Borderless Café” Events

TransferWise, a fintech company specializing in international money transfers, launched a series of pop-up events called “Borderless Cafe” in various cities worldwide.

The campaign’s central aim was to educate customers about the costs associated with traditional banking and the challenges they face while sending money abroad. It also showed how TransferWise’s innovative solutions will solve these challenges. This way, it generated awareness about its product and provided an enjoyable educational experience to its consumers.

Partnership Marketing

Partnership marketing is the broader concept of collaboration marketing, which includes any collaboration or partnership with other companies, such as licensing, sponsoring, or, more simply, partnering with third-party businesses or brands.

Suggested Read: A Complete Guide to Brand Marketing in 2024

Marketing for fintech is not easy, and many companies embark on creating strategic alliances with banks or financial institutions and e-commerce platforms considering their fintech model.

There are many examples, like personal finance management apps collaborating with banks to provide banking services to their customers. Fintech payment companies are partnering with e-commerce platforms to integrate their payment processing services, ultimately expanding their market size and growth.

Example: Paypal and Mastercard Partnership

Paypal and Mastercard collaborated to blend a massive combination of digital and global payment partnerships. Their collaborative environment expands PayPal’s global acceptance network and allows Mastercard users to leverage PayPal’s digital wallet and its convenience across a wide range of digital platforms.

Influencer Marketing

Affiliate referral marketing or influencer marketing is a model where businesses partner with third businesses or influencers to promote their products and expand their market by creating partnerships with influencers or personalities who have established connections and authority with their desired audience.

This way, businesses can reach every audience with influencer partnerships and provide them commissions or bonuses in exchange. They can collaborate with industrial experts and financial analysts to endorse their products and services and effectively communicate their credibility and fintech use cases to their audience.

Suggested Read: 7 Key Elements of a Successful Influencer Marketing Strategy

Example: SoFi

SoFi, a fintech company offering student loans, personal loans, and investment services, demonstrates a masterclass in influencer marketing to promote its products and services.

They hire financial influencers, social media personalities, and popular YouTubers who specialize in the finance sector and allow them to share their personal experiences and thoughts related to SoFi’s platform. By connecting with credible financial personalities, SoFi effectively reaches and showcases its company as a solution to its audience’s economic challenges.

Social Media Marketing

With more than 5.7 billion users on social media platforms, many businesses are leveraging social media presence, and that’s where fintech companies can benefit.

Social media campaigns can have a massive impact on fintech companies seeking to build their identity and awareness among their audience.

Fintech digital marketing has become more accessible due to the vast use cases of social media marketing, which can help generate massive impact and conversions.

Businesses can work on several terms to create actionable results like:

- Running paid advertisement campaigns to increase their visibility and growth.

- Implement User-Generated Content (UGC), such as customer testimonials in videos or posts, to build trust among the brand.

- Conduct interactive content on social media channels, such as polls, surveys, or social events, to better understand users’ preferences.

Example: Revolut

Revolut’s fintech marketing campaign used social media to inform users about the qualities of its digital banking and financial services products.

They encourage users to share their experiences with their product on their social media platforms and show how their company has helped them manage their finances effectively. Moreover, they also conduct social media contests and challenges, offering prizes to the participants who share the most entertaining content.

Wrapping Up

Fintech marketing is undoubtedly growing rapidly, and so is the competition, as firms constantly try to generate new ideas and solutions. With fintech marketing, businesses can create better ideas and innovations and scale their messages and solutions to their desired audience. Their robust strategies and unique benefits are cracking the code of earning new consumers with a high retention rate.

With Market Pro’s diverse portfolio and experience in fintech marketing. Our expertise can help you stand out from fintech’s competitive race and scale your brand to new heights.